Background

In the last decade, many coins have been

issued to follow Bitcoin's success using technology that is said to be the

fourth industrial revolution after weaving machines, conveyors and the

internet. The form of this fourth industrial revolution is widely called the

science and technology leaders that is blockchain.

A Roberts loom in a weaving shed in

1835, on that time textiles were the leading industry of the Industrial

Revolution and mechanized factories, powered by a central water wheel or steam

engine, were the new workplace.

The Industrial Revolution was the

transition to new manufacturing processes in the period from about 1760 to

sometime between 1820 and 1840. This transition included going from hand

production methods to machines, new chemical manufacturing and iron production

processes, the increasing use of steam power, the development of machine tools

and the rise of the factory system.

Textiles were the dominant industry of

the Industrial Revolution in terms of employment, value of output and capital

invested. The textile industry was also the first to use modern production

methods.

The Industrial Revolution began in Great

Britain, and many of the technological innovations were British. By the mid-18th

century Britain controlled a global trading empire with colonies in North

America and Africa, and with some political influence on the Indian

subcontinent, through the activities of the East India Company. The development

of trade and the rise of business were major causes of the Industrial

Revolution.

The Industrial Revolution marks a major

turning point in history; almost every aspect of daily life was influenced in

some way. In particular, average income and population began to exhibit

unprecedented sustained growth. Some economists say that the major impact of

the Industrial Revolution was that the standard of living for the general

population began to increase consistently for the first time in history,

although others have said that it did not begin to meaningfully improve until

the late 19th and 20th centuries.

An economic recession occurred from the

late 1830s to the early 1840s when the adoption of the original innovations of

the Industrial Revolution, such as mechanized spinning and weaving, slowed and

their markets matured. Innovations developed late in the period, such as the

increasing adoption of locomotives, steamboats and steamships, hot blast iron

smelting and new technologies, such as the electrical telegraph, widely

introduced in the 1840s and 1850s, were not powerful enough to drive high rates

of growth. Rapid economic growth began to occur after 1870, springing from a

new group of innovations in what has been called the Second Industrial

Revolution. These new innovations included new steel making processes, the

large-scale manufacture of machine tools and the use of increasingly advanced

machinery in steam-powered factories.

Continued by conveyor and internet

specifically in the end of 2000, now the world are welcoming new form of

industrial technology called blockchain. A blockchain, originally consist of 2

(two) words : “block” and “chain”, is a continuously growing list of records,

called blocks, which are linked and secured using cryptography. Each block

typically contains a cryptographic hash of the previous block, a timestamp and

transaction data. By design, a blockchain is inherently resistant to

modification of the data. It is "an open, distributed ledger that can

record transactions between two parties efficiently and in a verifiable and

permanent way". For use as a distributed ledger, a blockchain is typically

managed by a peer-to-peer network collectively adhering to a protocol for

validating new blocks. Once recorded, the data in any given block cannot be

altered retroactively without the alteration of all subsequent blocks, which

requires collusion of the network majority.

Blockchains are secure by design and are

an example of a distributed computing system with high Byzantine fault

tolerance. Decentralized consensus has therefore been achieved with a

blockchain. This makes blockchains potentially suitable for the recording of events,

medical records, and other records management activities, such as identity

management, transaction processing, documenting provenance, food traceability

or voting.

Blockchain was invented by Satoshi

Nakamoto in 2008 for use in the cryptocurrency bitcoin, as its public

transaction ledger.

Quoted from : https://www.linkedin.com/pulse/whats-next-generation-internet-surprise-its-all-don-tapscott

by Don & Alex Tapscott, authors Blockchain

Revolution (2016) , “The blockchain is an incorruptible digital ledger of

economic transactions that can be programmed to record not just financial

transactions but virtually everything of value.” To easier understand

blockchain, it can be imagined the network designed to regularly update

spreadsheet. Picture a spreadsheet that is duplicated thousands of times across

a network of computers.

Information held on a blockchain exists

as a shared — and continually reconciled — database. This is a way of using the

network that has obvious benefits. The blockchain database isn’t stored in any

single location, meaning the records it keeps are truly public and easily

verifiable. No centralized version of this information exists for a hacker to

corrupt. Hosted by millions of computers simultaneously, its data is accessible

to anyone on the internet.

The blockchain network lives in a state

of consensus, one that automatically checks in with itself every ten

minutes. A kind of self-auditing

ecosystem of a digital value, the network reconciles every transaction that

happens in ten-minute intervals. Each group of these transactions is referred

to as a “block”. Two important properties result from this:

Transparency data is embedded within the

network as a whole, by definition it is public.

It cannot be corrupted altering any unit

of information on the blockchain would mean using a huge amount of computing

power to override the entire network.

Anything that happens on it is a

function of the network as a whole. Some important implications stem from this.

By creating a new way to verify transactions aspects of traditional commerce

could become unnecessary. Stock market trades become almost simultaneous on the

blockchain, for instance — or it could make types of record keeping, like a

land registry, fully public. And decentralization is already a reality.

A global network of computers uses

blockchain technology to jointly manage the database that records Bitcoin

transactions. That is, Bitcoin is managed by its network, and not any one

central authority. Decentralization means the network operates on a

user-to-user (or peer-to-peer) basis. The forms of mass collaboration this

makes possible are just beginning to be investigated.

The blockchain potentially cuts out the

middleman for these types of transactions.

Personal computing became accessible to the general public with the

invention of the Graphical User Interface (GUI), which took the form of a

“desktop”. Similarly, the most common GUI devised for the blockchain are the

so-called “wallet” applications, which people use to buy things with Bitcoin,

and store it along with other cryptocurrencies.

By storing data across its network, the

blockchain eliminates the risks that come with data being held centrally.

Its network lacks centralized points of

vulnerability that computer hackers can exploit. Today’s internet has security

problems that are familiar to everyone. We all rely on the “username/password”

system to protect our identity and assets online. Blockchain security methods

use encryption technology.

The basis for this are the so-called

public and private “keys”. A “public key” (a long, randomly-generated string of

numbers) is a users’ address on the blockchain. Bitcoins sent across the

network gets recorded as belonging to that address. The “private key” is like a

password that gives its owner access to their Bitcoin or other digital assets.

Store your data on the blockchain and it is incorruptible. This is true,

although protecting your digital assets will also require safeguarding of your

private key by printing it out, creating what’s referred to as a paper wallet.

The blockchain gives internet users the

ability to create value and authenticates digital information. Result of new business applications as follow :

1.

Smart

contracts

2.

The

sharing economy

3.

Crowdfunding

4.

Governance

5.

Supply

chain auditing

6.

File

storage

7.

Prediction

markets

8.

Protection

of intellectual property

9.

Internet

of Things

10. Neighbourhood Microgrids

11. Identity management

12. Anti Money Laundering (AML) and

Know Your Customer (KYC)

13. Data management

14. Land title registration

15. Stock trading

As can be seen above, blockchain

technology is able to touch wide range of human life. There is the value of

blockchain technology, which is possible to make the creation of

crypto-exchanges and assets.

Many reason to develop crypto currency,

among them are data that can be obtained from Google report. Since the

beginning of 2017, it can be seen that the number of :

a.

search

requests for crypto currency among users has increased by more than 250%.

b.

requests

for types of crypto-currencies has increased by 560% since the beginning of year

2018.

c.

Also

can be found total number of requests for mining in the reporting period increased

by 560%.

Problem

arisen from cryptocurrency development

Due to high interest on many people

around the world to utilize this blockchain technology, there is a huge project

scattered around the crypto currency space. There are some new tokens can

succeed from its issued but not the least of which are fail with various

reasons. There are a good project concepted but due to lack of advertising then

this project is not successful. There are some project also with concepted

inappropriately but it can succeed during the ICO but unable to carry out continuously.

These phenomenon surely will caused to lose for many parties involved such as

investor, developer and other users.

Above problems are faced by many

involved parties, not only individual to be faced even also large companies faced

with false and inefficient projects in crypto-currency space. As natural characteristic

to be independent means it is not regulated by anybody including government of

certain country, then it is purely depend on the market and public. So the

problems arisen aforesaid should be minimized accordingly used by same method

which is not contrary with blockchain characteristic.

From this point of view, Revizor is rising

into crypto currency space to minimize those problems with some advantages that

will not be found on any other type of coin even now only revizor is the only

coin which capable of handling the above problem.

Who,

What Is Revizor Coin and How to Overcome the Problems?

As

aforesaid that Revizor team departs from observe latest technology development

and situation recently which has influenced the cryptocurrencies community. As says

in Revizor white paper, this team see necessity to reform fundamentally of the

crypto-currency market, which will facilitate its transition to a qualitatively

new level.

Currently

the Revizor team sees a need for a market regulation process which should only have

the possibility by filtering it from

false and ineffective projects in its implementation in the crypto-currency space.

Before

continue to further explanation, it is better in the beginning to know who is

the team involved in this futuristic project. Here is the key team of Revizor

coins :

1.

Yuliya Zhurba as CEO, head of

legal sphere, and integration strategy

2.

Nikolai Gonzharuk as chief of

telecommunications

3.

Levgen Nikutin as Chief technology

officer

4.

Oliga Bubyr as executive activity,

accounts department

5.

Nick Burun as promotion in social

media & SEO

6.

Ludmila Kyazeva as graphic designer

of the project

As

aforesaid that Revizor coin high development of crypto currency situation

recently which has influenced the crypto community. As said at Revizor website

: https://revizor-coin.io/, it can be

found description of Revizor as follow :

“Revizor

is an innovative project in the field of regulation of the crypto-currency

market, the main task of which is to create software tools that would filter a

wide range of assets by absorbing unpromising tokens. Advantages of RevizorCoin

is that to date there is no similar project in blockchain. About a thousand

different coins as a result of the introduction of Revizor will be absorbed,

making it possible to blockchain system cleaning. RevizorCoin is the only coin

that does not need mining, as its owners will constantly increase their capital

in a certain arithmetic progression after each absorption of illiquid coins.”

In the whitepaper of Revizor can be found also about additional

description of it as quoted below :

“Revizor

is the first crypto-derivative. The absorbed assets will be considered publicly

on our channel and in social networks.

Among them there are interesting projects, but due to the shortage and

lack of advertising these projects did not gain the declared capitalization and

lost value. After the acquisition of such coins, an auction is held by us for

auctioning the crypto-derivatives of illiquid tokens, which will be of interest

to individual companies for the completion of these projects and their

re-launch in an improved form.”

From

above description it can be known that Revizor description as below :

1.

Revizor is a software tools that

can filter a wide range of assets by absorbing unpromising tokens in form of

illiquid coins

2.

Revizor can clean the Blockchain

system by absorbing unpromising tokens

3.

It is not necessary to mining Revizor

coin

4.

Revizor is a first crypto-derivative

5.

Revizor has ability to return the

illiquid coins to be re-launched in an improved form that can be carried out

with a party who win the auction held by Revizor.

By using the 5th ability of Revizor, it can be seen

that there will be a second chance for a developer to to return their

investments and thereby participate in the RR.

Perhaps a question could be come up how can be the failed coins

to be revived by such incredible Revizor coins? The questions is answered by

the Revizor working. Described in the whitepaper that the principle of Revizor

is the creation of a range of tools that allow filtering exchange flows from

deliberately unrealizable and fraudulent crypto assets. If the assets of crypto

is goods and promising, then it will be passed the filter application then to

be informed to the public. If the owner of developer knew this coin are

displayed, he can participate in an auction to be held by Revizor. If he

obtained again that coins, then Revizor will help to advertise the coins in

wider coverage including use the television to be owned by Revizor for better

advertising as trusted the key of business. This second chance is believed to

be able returning the investment of the developer made and also the coins will

be successful. The fund expensed by developer will be returned and there is

possibility making profit in second chance. So the investors involved will earn

benefit from the token of a project that is good and promising issued especially

when it is implemented.

Revizor underlines the word : project promising specially in the

implementation because there was a project which is good on that time but not

good on implementation. Revizor will filter these kinds of tokens to be not

passed, since such coins can hurt many investors. As quoted from Revizor

whitepaper, there was a cryptocurrency project happened in 2015, it had

attracted 6,019,420 USD just for 24 hours!!! Incredible…. However as of

September 22, 2017, its value is $ 0.002594 with a zero capitalization level.

This speaks first of all about the failure of the project. Revizor observes such

projects very often, this kind of project to be filtered. .

In simpler words, there are 3 (three) principles or Revizor

works as below :

1.

Filtering fraud, unpromising

tokens that will be difficult to be implemented.

2.

Spreading the information of

promising project to the community

3.

Provide auction for good and

promising projects but it was failed for previous ICO

While the advantages of Revizor as quoted from their website https://revizor-coin.io/#advantages/

:

1.

Exchange of illiquid coins

2.

Bank of data – RevizorCoin

3.

Revizor Coin TV

4.

Auction of blockchain assets

1.

Exchange of illiquid coins

The

principle of Revizor is the creation of a range of tools that allow filtering

exchange flows from deliberately unrealizable and fraudulent crypto assets. The

exchange will be made automatically. For each category of coins will be

established its profitable course for everyone. The degree of liquidity of a

particular assets ultimately determined by the market itself. By exchanging

this project`s coins for RevizorCoin, the owner has a second chance to return

their investments and thereby participate in the RR. Due to the absorption of

other coins, not only the price will grow, but also the amount of RR for their

owners will increase.

2.

Bank of data – RevizorCoin

Analysis of financial flows.

Is an essential advantage of the

Revizor project.

It is an information field in

which will regularly appear information on absorbed tokens .

Their quantitative indicator will

characterize the liquidity of a project, as well as point to the prospects for

its further development.

In addition, the analytical data

bank will contain the following information:

1) the offer to sell the project

or its share;

2) announcements of the start of

sales through the Revizor`s auction of the tokens absorbed by our project, as

well as the products put up for sale by others in the field of blockchain

(ideas, copyrights, already launched sites, crypto currency exchangers and so

on).

3.

Revizor Coin TV

One of the priorities for the

Revizor team is the creation of its own television channel. Revizor Coin TV

will expand the crypto-currency information space on the sphere of television.

The information flow on RevizorCoin TV will be based entirely on clarifying new

technologies for improving the blockchain, conducting new ICOs, creating

opinion polls, etc. The TV will be broadcast around the clock in a wide range

of broadcasting formats. Thus, we will be able to reach the maximum number of

audiences. Also, an online broadcast via the Revizor`s website is being

prepared.

4.

Auction of blockchain assets

It

represents a unique platform for the development of the blockchain community.

Systematically, Revizor will conduct auctions at which the absorbed coins will

be exhibited. In addition, anyone can put up for sale at our auction, their

blockchain product (idea, copyright, site, cryptocurrency exchange, etc.). Regularly

at the auction will be sold products of all kinds of innovative technologies,

interesting developments and ideas. Sale of an absorbed set of tokens, as well

as other lots, exhibited at our auction will begin with a minimum price. This

gives a chance to buy any participant of the auction a large part of the crypto

assets of the absorbed projects, as well as ideas in the field of blockchain

for their further implementation, copyrights to certain developments, already

created sites , cryptocurrency exchangers, and so on. In addition, the makers

of failed projects can also buy coins. Thus, they will prove their honest

intentions and will be able to re-instill confidence in their project. Thus, in

the auction to participate in the quality of both the seller and the buyer will

be able to any: from a simple user to the company.

The general overview of RevizorCoin can be presented with a

graph as below :

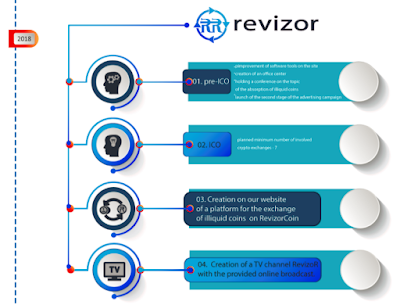

Timeline and Roadmap of Revizor Project

To realize the idea of RevizorCoin, team has formulated

the time required and the stages of what should be performed. Revizor team had

studied cryptocurrency technology and blockchain networks to be able for implementation

since January 2017. Revizor team launched a the website on October 2017,

Pre-ICO on January 2018, ICO on March 2018 and to create Revizor Platform on

June 2018.

Specifically started from ICO, the roadmap of revizor can

be seen in below picture :

Fund Management Planning

Revizor team

will manage the plan of this fund management through 2 (two) scheme, the first

is RevizorCoin Distribution thorugh ICO and the second will be reserved for the

exchange.

Total issued

800 million RevizorCoin:

-

30% of coins will be distributed at the ICO stage

conditions for

the exchange of illiquid coins: buying 1 RR on the stock exchange, a purse is

opened with the possibility to exchange illiquid tokens to this purse

-

70% of coins are reserved for the exchange of illiquid crypto assets on

RevizorCoin

this

project is necessary in connection with the daily receipt of these currencies

* The situation described above is hypothetical. The

purpose of the example is to show an eventual scenario.

Further

information can be referred to below link :

bitcointalk username : hurry_hore

Tidak ada komentar:

Posting Komentar